The City of Buenos Aires and the provinces of Chubut, Entre Ríos, Mendoza, and Misiones have committed to being the first to adhere to the Consumer Fiscal Transparency Regime established in Law 27.743. The NGO Lógica, which aims to raise fiscal awareness in society and was the promoter of this regime, sent requests to the provinces to join. Other provinces are expected to respond soon to this initiative.

In a letter sent to the 24 governors, the NGO raised two questions: whether they will promote adherence to the Regime so that gross income and municipal taxes appear on purchase receipts, and whether there will be penalties for businesses that voluntarily inform consumers about these local taxes. Of the five mentioned provinces, all responded affirmatively to adherence to the Regime and the non-application of penalties in these cases.

Matías Olivero Vila, president of Lógica, emphasized that the lack of fiscal awareness has led to high levels of taxes and inflation in the country and that financial transparency is essential to demand logical taxes and public spending. The adoption of this Regime marks the end of decades of concealing taxes from consumers.

In their responses, the provinces explained their reasons for joining the Regime. The City of Buenos Aires cited constitutional mandates favoring consumers, while Chubut, Mendoza, Entre Ríos, and Misiones expressed their commitment to fiscal transparency and trust in the government.

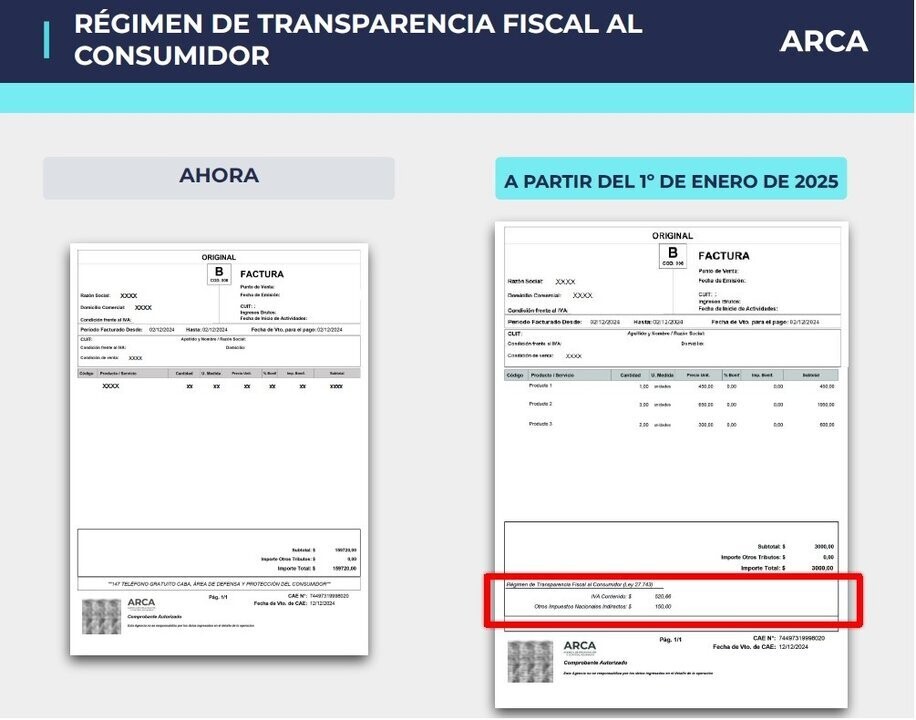

The law establishing this Regime requires that taxes such as VAT be displayed on purchase receipts, a measure that has already been implemented in large companies since January and will be extended to all businesses starting in April. It is essential for other provinces to join the Regime soon to maintain uniform information across the country.